February 2025 marks a critical juncture for Nigeria’s microfinance sector as we approach the March 31st deadline for regulatory compliance with the Central Bank of Nigeria mandates.

Regulatory Compliance: Countdown to March 31st: Act Now to Avoid Penalties

With just weeks until the March 31, 2025, deadline, MFBs must prioritize compliance with the CBN’s Cybersecurity Reporting and Assessment Report, Nigeria Data Protection Regulation (NDPR) Audit, and Vulnerability Assessment & Penetration Testing (VAPT). Non-compliance risks severe sanctions, including fines, operational restrictions, or reputational damage.

Immediate Action Steps for Microfinance Institutions:

- Assess Your Status: Conduct a thorough audit of your current compliance level with cybersecurity, data protection, and IT security standards.

- Engage Experts: Partner with MLDC to gain cost-effective access to CBN-approved consultants for tailored, cost-effective solutions in Cybersecurity Reporting & Assessment, NDPR Audit, and VAPT assessments.

- Submit Early: Avoid last-minute rushes by submitting reports well before the deadline to ensure accuracy and CBN approval.

Key Moments In February

Women’s World Banking Project: Smart Lending: Enhancing Business Skills & Digital Capabilities

As part of our commitment to financial literacy and sustainable lending practices, Mldc NG in collaboration with namblagosstate NAMBLAG successfully implemented the Women’s World Banking project themed: Smart Lending: Business Skills and Digital Capabilities for Better Lending Outcomes at NECA House, Ikeja. This initiative attracted over 200 representatives of microfinance finance institutions all over Lagos, emphasizing the critical role of financial education in improving loan performance and driving financial inclusion.

Key Benefits to the Microfinance Sector

- Reducing Non-Performing Loans (NPLs) – By equipping entrepreneurs, particularly women, with business and digital skills, the project enhances their ability to make informed borrowing decisions, thereby reducing loan defaults.

- Strengthening Creditworthiness – Participants gained practical knowledge on financial planning, record-keeping, and digital banking, ensuring better loan repayment habits.

- Expanding Financial Inclusion – By integrating digital literacy with smart borrowing strategies, more underserved businesses can now access structured credit facilities with confidence.

- Tech Tools For Safer Borrowing – By introducing AI and machine learning into the borrowing process, microfinance professionals are able to arrive at faster and safer borrwing conclusions and are able to make make loans available to recipients faster and recovery more seamless.

Through initiatives like this, Mldc NG aims through partnerships with other institution of similar focus to continue to empower microfinance institutions by building a more resilient lender and financially literate borrowing community, ultimately enhancing the sector’s stability.

Free Webinar Recap: Cybersecurity & Data Protection for MFBs: A Game-Changer

In partnership with KPMG Nigeria, MLDC hosted a free cybersecurity technical workshop for MDs and Directors of Microfinance banks on February 7, 2025. This free workshop was attended by over 120 senior leaders, MDs and Board Directors of MFBs. This strategic sensitization workshop, anchored by Samuel Femi Asiyanbola, Partner, Cyber and Privacy Advisory, KPMG Nigeria, highlighted the importance of robust cybersecurity and data protection frameworks for protecting banks reputations, safeguarding customer sensitive data, and meeting CBN regulatory standards.

Key Takeaways:

- The urgent need to comply with CBN’s cybersecurity and NDPR regulations by March 31, 2025.

- Practical steps to build internal controls, mitigate risks, and maintain long-term compliance.

- Insights into CBN reporting standards and how MFBs can prepare for future audits.

Testimonial:

The Cybersecurity webinar was both timely and impactful. The discussions provided critical insights into strengthening cybersecurity frameworks within the sector. Many of the issues highlighted during the session are now emerging as pressing realities for the sector, reinforcing the need for continuous learning and proactive compliance. – Dr. Roy Ndoma-Egba, Chairman of the Board, CSD MFB.

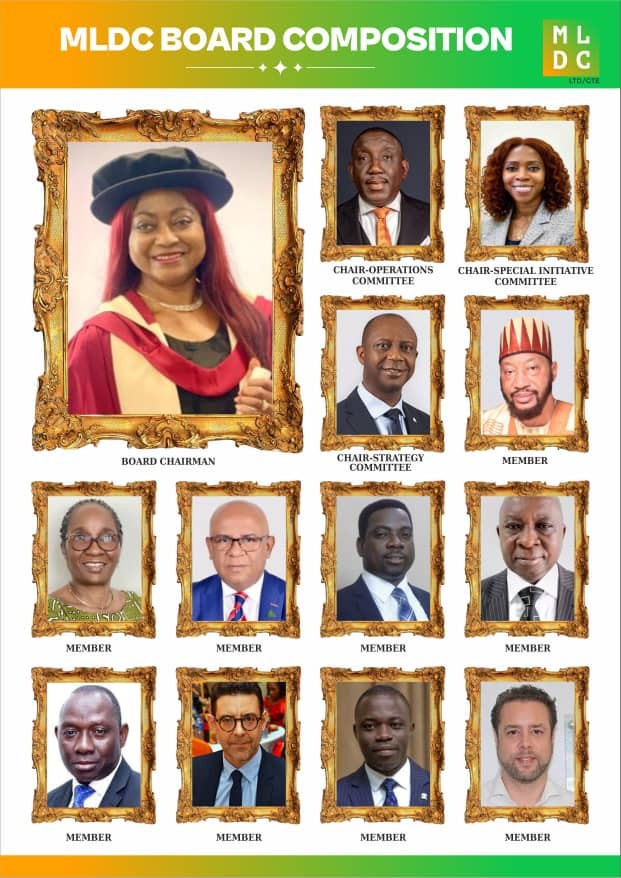

MLDC Board Welcomes New Leaders: Strengthening Our Vision

We’re thrilled to announce new members of the MLDC Board, enhancing our collaboration with Nigeria’s microfinance sector:

- Mr. Johnson T. Anifowoshe – Director, Special Insured Institutions Department, NDIC specializes in financial regulation and oversight. Read his bio here

- Mr. Habeeb Yusuf – MD, NPF MICROFINANCE BANK PLC, succeeding Mr. Akinwunmi Lawal, former MD, NPF Microfinance Bank, Plc. Meet Mr. Habeeb here

- Alhaji Abubakar Adamu Ahmed – National President, National Association of Microfinance Banks (NAMB). Read Alh. Abubakar’s bio here

- Mr. David Adelana – Head, Microfinance Banks Division, Representing OFIS-D, CBN. Read Mr. David’s bio here

New Services to Strengthen Your MFB: Leadership, Talent, and Resilience

In our bid to buttress and reinstate our commitment to combat brain drain, curtail talent poaching, and ameliorate JAPA effects on the workforce within the sector, Mldc NG is committed to empowering MFBs with innovative solutions to navigate compliance challenges and drive sustainable growth. Explore our latest offerings:

Executive Recruitment Program:

Strong leadership is the cornerstone of MFB success. Our Executive Recruitment Program connects MFBs with experienced, forward-thinking board members to enhance governance, strategic planning, and decision-making. Benefit from diverse expertise to position your institution for long-term growth.

Talent Recruitment Program

Address workforce gaps caused by the “JAPA syndrome” and high turnover with our specialized Talent Recruitment Program. We connect MFBs with talented top-tier professionals—Business Development Officers, IT & Risk Officers, and Compliance Personnel, maintaining a high-performing workforce and boosting operational efficiency.

Contact Us:

Visit www.mldc-ng.com or email info@mldc-ng.com for more information or to schedule a consultation.

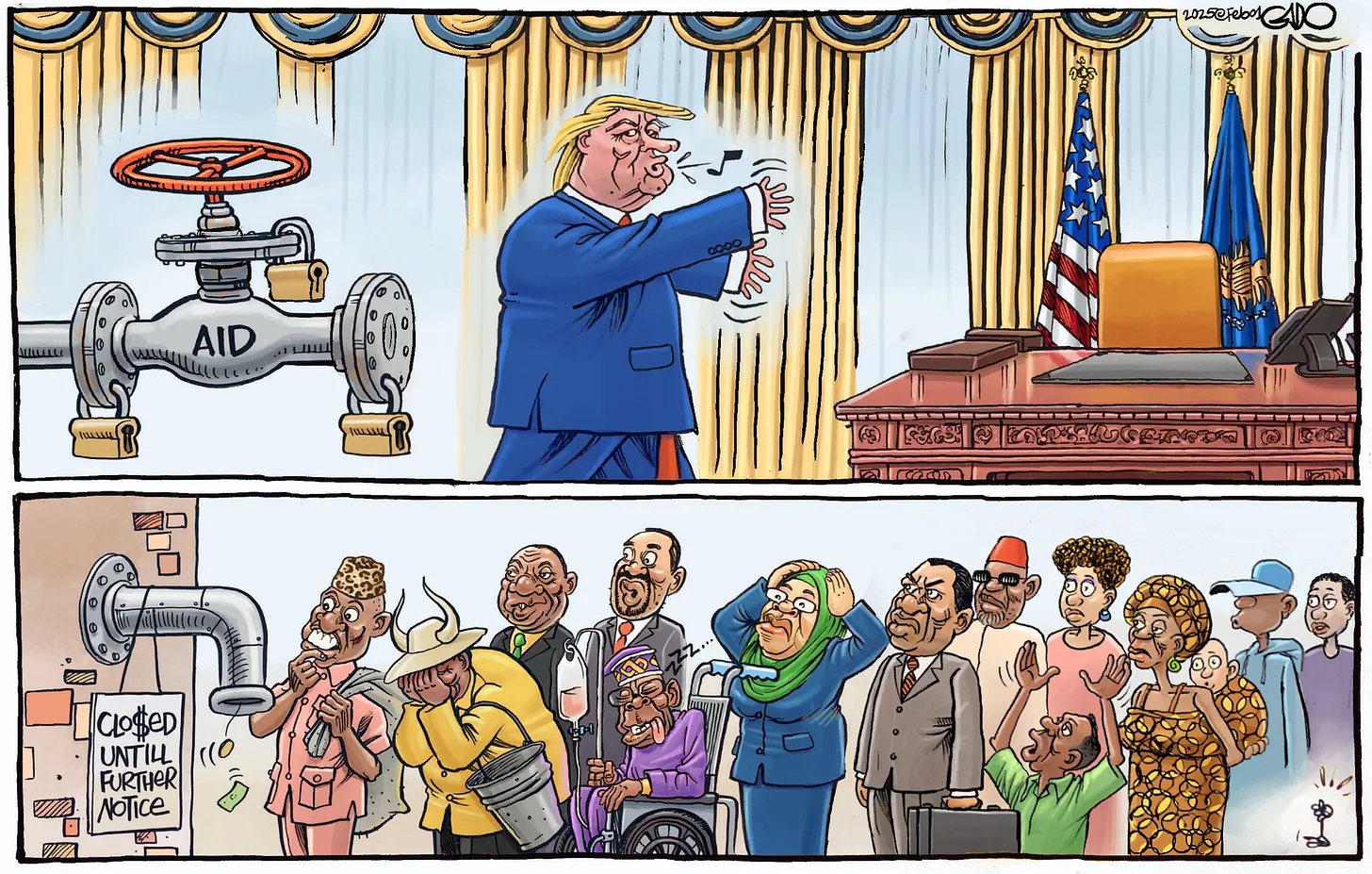

Matters Arising: Global Aid Cuts

Fund Cutting and Its Effects on INGO Projects in Nigeria: Opportunities for MFBs

International funding cuts are creating profound challenges for development projects across Africa, with Nigeria bearing a significant burden. Major donors have reduced foreign aid due to shifting domestic priorities, directly impacting the operations of international non-governmental organizations (INGOs) in Nigeria. The United States, under its “America First” policy, announced a freeze of nearly all foreign aid on January 24, 2025, for a 90-day review, potentially cutting billions from programs previously supporting Nigeria’s health, education, and humanitarian sectors as well as several other countries. Germany in January 2024 slashed its international development budget by €2 billion ($2.2 billion USD), while the Netherlands and the United Kingdom have scaled back funding by €8 billion ($9 billion USD) over 2024–2028 and £1.55 billion (~$2 billion USD) since 2019, respectively. Collectively, these reductions amount to over $12 billion in global aid cuts since 2023, severely affecting African economies, including Nigeria.

Projected Impact on Nigeria:

- Delayed or Abandoned Projects: INGOs are scaling down or halting critical initiatives in healthcare, education, and financial inclusion. Various health initiatives, which provided essential healthcare services to rural communities, will be forced to reduce operations due to funding shortfalls, risking the health outcomes of millions.

- Reduction in Humanitarian Aid: Programs addressing food security and public health face significant gaps. In Nigeria’s Northeast, where 7.8 million people require assistance due to conflict and climate shocks, the 2025 Nigeria Humanitarian Needs and Response Plan ($910 million needed) is now at risk, with U.S. funding, a key contributor previously accounting for 47% of global humanitarian appeals in 2024—frozen pending review.

- Greater Burden on Local Economies: The withdrawal of international support places immense pressure on Nigeria’s government and private institutions to fill funding gaps. With Nigeria’s 2025 budget allocating only 4.8% ($1.76 billion) to health, microfinance banks and local NGOs are increasingly called upon to bridge the void, straining their own resources.

Example Impact:

The U.S. aid freeze alone could jeopardize over $600 million in health assistance previously provided in 2023, affecting programs like the President’s Malaria Initiative, PEPFAR, and vaccine delivery, which have been vital in reducing malaria cases (68 million in Nigeria in 2021) and HIV transmission (1,400 new cases weekly in 2023). Similarly, German and Dutch cuts are reducing support for education and livelihood programs, while UK reductions since 2019 have already scaled back aid to least developed countries, including Nigeria, by 55%.

How MFBs Can Fill the Gap:

- Provide Alternative Financing: Support SMEs, women-led businesses, and grassroots initiatives to sustain economic growth.

- Foster Financial Inclusion: Expand banking access to underserved communities for long-term resilience.

- Strengthen Local Economies: Use microfinance to sustain community projects and drive independence.

While this shift poses risks to essential services and economic stability, it also presents an opportunity for Nigeria to strengthen domestic financial mechanisms. Microfinance institutions can play a crucial role by providing alternative financing, fostering financial inclusion, and driving local economic sustainability and resilience. To mitigate the long-term effects of these aid cuts, Nigeria must prioritize sustainable financial solutions that empower communities and reduce dependence on external funding.

Upcoming Training Programs – March 2025: Equip Your Team for Success

Stay ahead with MLDC’s specialized workshops to meet compliance requirements and enhance operations:

- Cybersecurity Technical Workshop – March 13, 2025 (Hybrid) Register Here

- Innovative Credit Marketing Strategy for MFBs – March 19-20, 2025 (Hybrid) Register Here

- AML/CFT Compliance for MFBs – March 25, 2025 (Virtual) Register Here

CEO’s Message: Building Resilience Together

As we navigate the March 31 compliance deadline and global aid cuts, MLDC remains committed to supporting MFBs in achieving regulatory excellence and driving sustainable growth. Together, we can build a resilient financial sector. Act now to secure your institution’s future. – Adetunji A., CEO, Mldc NG

Don’t Wait—Secure Compliance and Growth Today!

Visit www.mldc-ng.com or email info@mldc-ng.com / training@mldc-ng.com for inquiries, consultations, or to register for training. Let’s work together to ensure your MFB thrives in 2025!

Leave A Comment